How aspiring millennial home buyers can take advantage of back doors into the property market

For those under 40, the ‘Australian dream’ of owning a property has become an increasingly challenging prospect, but there are some savvy ways that young buyers can get their first step onto the property ladder.

In the last two decades, house prices have skyrocketed to 16 times the median wage, versus four times in the 1980s. Jobs have become casualised and precarious, university debts are mounting alongside credit card debts. Then coronavirus struck.

Is the Australian dream dead for Millennials? According to finance expert Billie Christofi – there are plenty of other options than young Aussies can explore. Picture: Supplied

Since around mid-March 2020, 11.8 per cent of jobs for those under 30 have crumbled under the pandemic’s economical onslaught of Australia’s workforce.

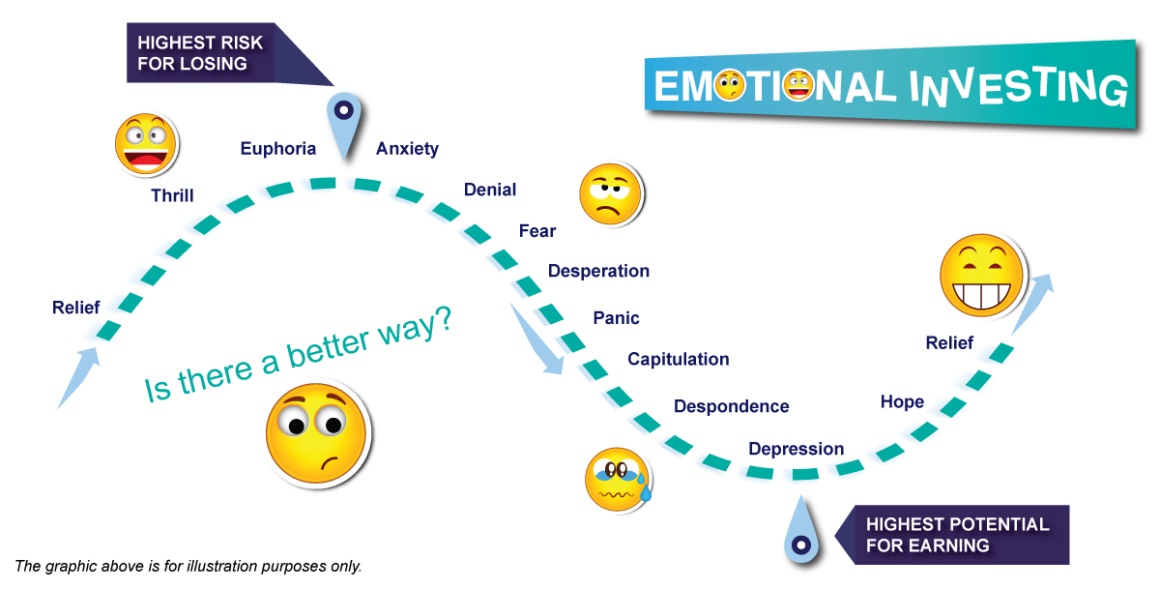

The class of 2020 will now be officially graduating into the country’s first recession in 29 years, and many have raided their scant Super funds at the worst possible time.

Millennials face years of wage inequality during the country’s post-pandemic rebuild, or have to re-skill toward industries with higher staff demands, adding to the existing shackles of student loan repayments.

The average HECS debt today sits at $20,303 – according to recent ATO figures – as the cost of degrees continue to rise for Australian students.

Millennials now face almost twice the amount of university debt of their predecessors who graduated in the 1990s – not to mention Baby Boomers, who had access to free tertiary education from the 1970s until mid-1980s.

Australia is reportedly the world’s second least affordable country to buy property.

Australia is reportedly the world’s second least affordable country to buy property.

This unfair disadvantage is topped by the increasingly tricky property landscape. According to Demographia’s latest annual housing market report, Australia is the world’s second least affordable country to buy property.

With a median household income of $48,360 and properties costing an average of $788,000, Australian house prices are a whopping 16 times the median wage versus four times in the 1980s, according to the most recent census data.

That may explain why an influx of young Australians are turning into ‘boomerang kids’, moving back home with their parents as a way of coping financially.

Financial Adviser and property investment expert, Billie Christofi, believes now is the time for young people to take action and reclaim control of their financial situation.

“The Australian dream is no longer about owning one property, in an area you might not even like, and living in it for the rest of your life,’ according to Mrs Christofi, founding director of Reventon Finance & Investments.

There are a number of investment strategies open to young Australians that can help them secure their financial future, even during these difficult times.

“The harsh reality is that most young Australians simply don’t have enough capital to afford a house deposit on their own. And now, with many placed on JobKeeper or JobSeeker subsidies which the banks look down upon, the way we look at investing needs to change,’ Mrs Christofi said.

A mum of four, Mrs Christofi now has more than 20 properties in her portfolio, and is trying to educate her children from an early age about money management and wants to share her advice with young Australians countrywide.

She is urging Millennials to consider three investment options; “rentvesting”, joining a property syndicate or partnering up with an investing buddy.

Rentvesting

‘Rentvesting’ is about buying where you can afford and renting where you choose to live.

“Life is short so, by “rentvesting”, you can still live the lifestyle you want while making contributions to your savings through an investment purchase elsewhere,” Mrs Christofi says.

Rentvesting gives first time buyers a chance to gain an initial foothold on the property ladder, and not necessarily have to sacrifice their lifestyle, or face an extended commute, by remaining in an area more favourable for them to live in.

“Given housing affordability issues it’s something young people are looking at more and more. A lot of the more premium areas are out of reach for many buyers but this is a great way to get their foot in the door, in terms of property,” said REA Group Chief Economist Nerida Conisbee earlier this year.

Ms Conisbee however warns that rentvesting should not be seen as a flipping-type alternative to property ownership. She said those who took on rentvesting as a viable option should be looking to keep their property for “at least two years, ideally five or more”.

“Investing should always be a long term approach,” she said.

“As the property increases in value, you can take the profits and then move on to your next step.”

Join a property syndicate

“You can get into the property market much sooner this way than waiting to do it on your own,” Mrs Christofi said.

“You can get paid a dividend for each property – similar to investing in shares but through your own property instead.

Mrs Christofi actually had great success getting her foot on the property ladder using the syndicate strategy back in the early 2000s.

“I bought into a commercial syndicate at the age of 16 with $16,000. At 22, I sold my portion for $45,000, which I invested into my first property purchase,” Mrs Christofi said.

“I had an extra $15,000 in savings, and the First Home Owners’ Grant, which I used to buy my first home for $440,000 in South Yarra in 2005.

“It did extremely well, so a year and half later I sold it with $140,000 gain, that then allowed me to accelerate my portfolio.

“I used those funds to buy two properties and worked hard at paying down the debt using the depreciation and tax savings.

Buddying up

Another great way to enter the market is by “buddying up” with a friend, family or colleague and purchasing a property together. This is a fantastic way to make your first investment if you don’t have enough for a deposit on your own.

“I have bought properties with other people, there are advantages to being able to buy something you may not have otherwise been able to afford to purchase, which is great.,” Mrs Chistofi noted.

“The downside might be that their circumstances change and your time frame of what you want to do with the property may be affected due to that.”

The founding director of Reventon Finance & Investments believes the first integral step toward building a secure and positive future first and foremost is about practising financial fitness.

“Let’s see this pandemic as an opportunity, not a setback. Many of us have started reading books again, developed a better routine, implemented a healthier diet or started exercising more,” Mrs Christofi says.

“We can treat money in the same way. Get financially fit by becoming more conscious of your spending habits. Do you really need more new clothes, or that pricey food delivery order? Or would you rather that money go toward your future so you can live comfortably down the track?

‘It’s so tough for young people right now. But now is the time to take action, reclaim control and start looking at financial options you might not have considered before,’ Mrs Christofi says.

‘I’m not just talking about investing in property. I really want young Australians to use this time and opportunity to invest in themselves, mentally and physically, toward building a healthier future.’

Former music teacher turned Buyer’s agent Lloyd Edge has highlighted some markets for budding young buyers to look into.

Where should you be looking to buy?

If you’re a millennial trying to crack into the market, it can be quite a daunting process of trying to work out what market to buy into, but it is definitely worthwhile to look beyond the area you live in for best chance at value.

“I definitely recommend regional – it is a lot more affordable and there have been great results with growth in certain regions – particularly Geelong,” Mrs Christofi says.

“The property prices are in a good range, and you get regional benefits with grants so, if you combine that with rental income and tax benefits, your out of pocket expenses are minimal. Also, with the state of circumstances right now, a lot of people are moving regional, which means you probably won’t be affected by vacancy rates as much as if you were looking at city areas.”

Former music teacher turned Buyer’s agent at Aus Property Professionals Lloyd Edge has also done his own analysis of regional areas that buyers should be looking to consider.

Find out the right areas you should be looking to buy property.

NEW SOUTH WALES

“If you’re looking at going regional for your next investment, you don’t need to stick to the large regional centres to get your investment portfolio off and running and Mudgee, NSW,” Mr Edge says.

Regional hubs such as Northern Queensland are worth looking at for investment opportunities.

QUEENSLAND

“Young investors are finding they are really getting the most bang for their buck in regional Queensland, according to Mr Edge.

“The Sunshine Coast suburb of Caloundra, QLD, is proving to be a good bet, with ultra-low vacancy rates (less than 1%) and decent rental yields (median is about 4.5%) with the median house price of only $490,000.”

VICTORIA

“Mount Pleasant, a suburb of Ballarat, has been the unassuming bridesmaid town that is now starting to take the spotlight due to the median price for a house being only $350,000 – and it may be of surprise to you that the median rental yield is 4.9 per cent.”

“This affordability factor is what makes this suburb so attractive to homeowners and keen eyed investors have noted that Mount Pleasant’s price point is below Ballarat’s median of $424,500,” Mr Edge notes.

SOUTH AUSTRALIA

Barossa and Claire Valley are great areas for growth and returns, while Kangaroo Valley is an up and comer for lifestyle opportunities.

TASMANIA

“Hobart has the most affordable median house price compared to all the other capital cities so staying close to the capital might be a good option,” Mr Edge notes.

Looking 20km north of Hobart CBD, Brighton has shown promising signs for investors in recent years with a 10% median price increase despite the COVID-19 pandemic and 20 per cent increase when looking at the 2-year median price change.

Originally published by realestate.com.au

By Brendan Casey