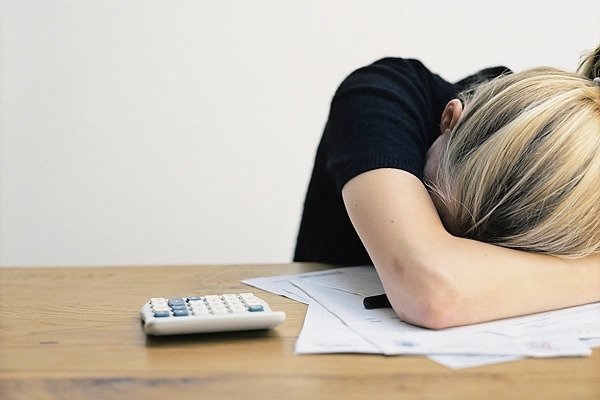

7 signs you're not as good with money as you think you are

08/03/2023

Everyone has to deal with their money, and some of us do it better than others. If you think you’re a master of handling your personal finances — or you’ve never given a thought to your level of expertise — take a look at the points below. Your approach might not be as flawless as […]